Property Investment Calculator (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

DESCRIPTION

Investing in single family homes is just like any other investment.

You will have some initial acquisition cost, potential financing, rent and expenses with escalations, some defined holding period, and potentially an exit based on a defined cap rate.

This template covers all basis of the above in an easy-to-understand format so anyone can understand the ROI of a given rental property they are looking into buying. Single family acquisitions is big business so get the numbers right first.

Note, the model has been extended from a max of 10 years to 30 years.

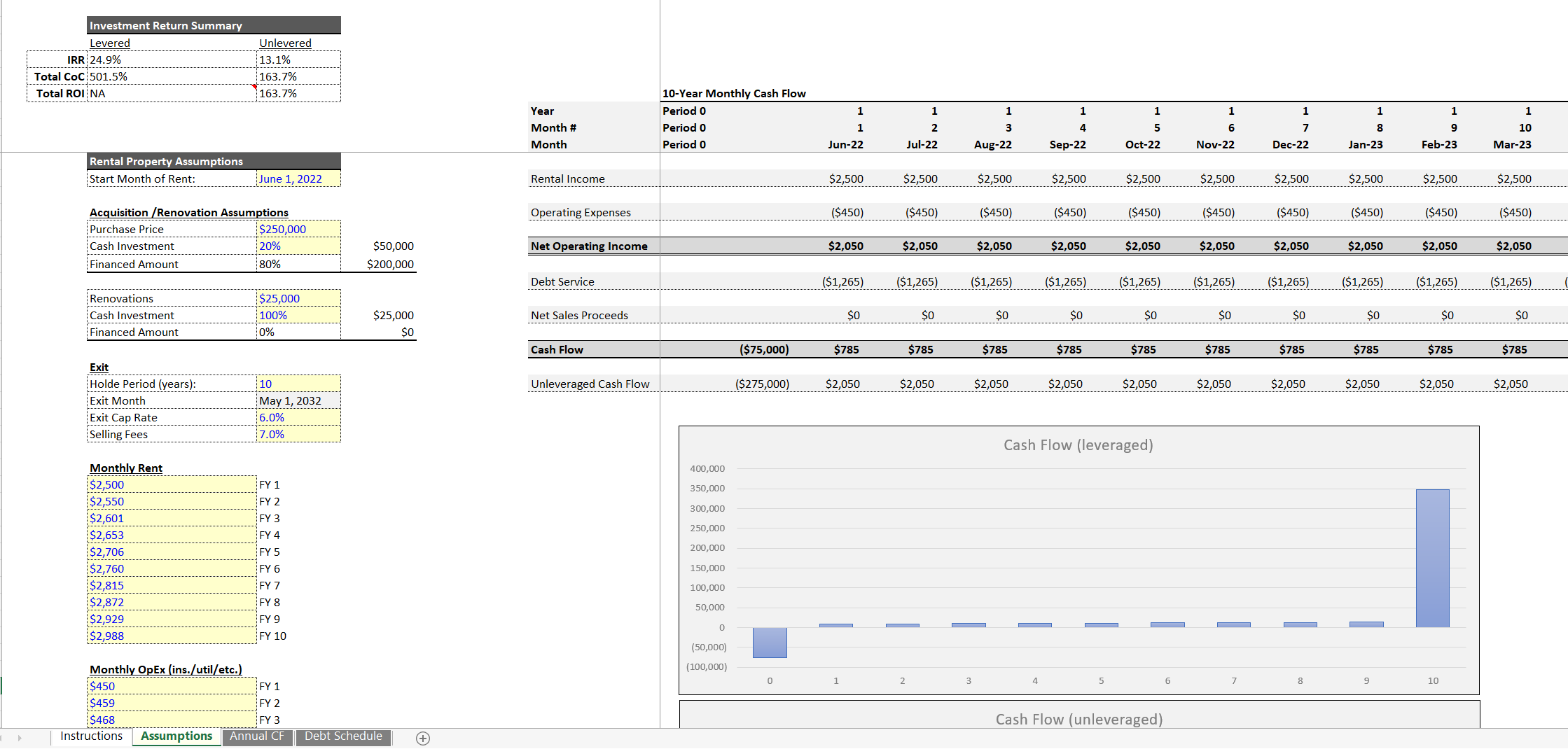

This has all the assumptions you need to run an investment analysis for a rental property. The inputs are easy to use. Simply enter:

• Purchase price

• Closing costs / renovation

• Starting monthly rent / growth

• Starting monthly expenses / growth

The model goes out for a maximum length of 30 years. Monthly and annual cash flow is displayed.

You can define a percentage of the purchase price that is financed if applicable.

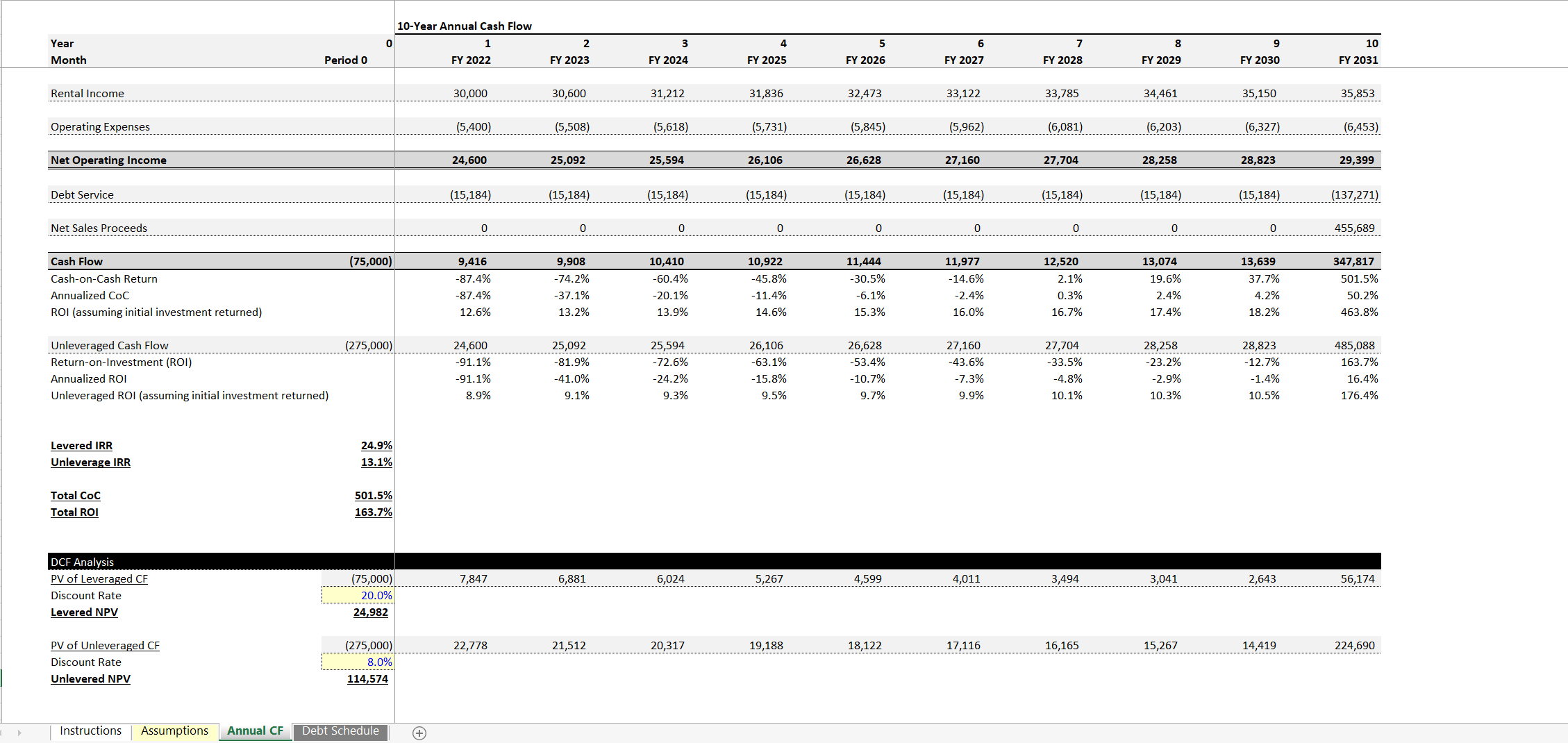

The model produces net operating income and leveraged / unleveraged cash flow, including visualizations.

The analysis can be run for any amount of time and the sales proceeds will be defined as a function of the end year annual NOI against a defined cap rate.

Output Metrics:

• IRR (leveraged/unleveraged)

• ROI (per year, annualized, and total)

• CoC (per year, annualized, and total)

There are all kinds of more advanced analysis that can be done on top of this base logic, such as adding a refinance event, adding depreciation, tax consequences on operations / gain/loss at sale, and a joint venture waterfall with LP / GP equity contributes. Explore more of the real estate financial models here on the site to see what can be added.

This template provides a comprehensive breakdown of both leveraged and unleveraged cash flows, ensuring you can assess the financial viability from multiple angles. Detailed visualizations and clear metrics make it easy to interpret complex data, empowering you to make informed investment decisions.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model, Company Financial Model, Business Plan Financial Model, Real Estate Excel: Property Investment Calculator Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Real Estate Underwriting Templates / Deal Analyzers

This bundle contains 25 total documents. See all the documents to the right.